Due to the dramatic decrease in supply as we near the end of the year, demand has crossed above supply. This pattern which we saw most of the time during the past several years puts UPWARD pressure on prices and generally signals higher prices depending upon how long it lasts. As was mentioned last month that the trend seemed to have changed has come to pass. We'll see how this new trend change will last. Still, sellers need to be more aggressive as to list prices as the market is lower than the market peak which occurred back in Spring 2018. Buyers are still looking at low mortgage rates but with the decrease in inventory as we get into the Holiday Season there will be more competition when it comes time to submit an offer.

For November results, we see that the Santa Clara County median price for single-family residences is the same as it was the same month a year ago. In San Mateo County the median price stood at $1,610,000 versus $1,500,000 the same month a year ago.

Condo and townhouse median price in Santa Clara County settled at $799,000 in November compared to $850,000 last year or a decrease of 6.0%.

November Nuts and Bolts: Inventory or the number of homes available for purchase in Santa Clara County was 706 down sharply from last year of 1,075 or 34.3%. Closes were 835 and 5.6% higher from the same month last year when it was 791. This blows the theory oft spread by some agents and in the media who state that sales/closings are constrained by low inventory levels. They lose sight of another major variable in their research of turnover.

For San Mateo County, inventory of single-family residences stood at 324 versus 388 a decrease of 16.5% from November 2018. Closes were 335 compared to 345 for the same month last year, a decrease of 2.9%.

Sale price to list price ratio, a key market condition indicator, shows that for Santa Clara County transactions completed during the month, this stood at 100.2% compared to last year's ratio of 100.5%. 40.8% of homes in Santa Clara County that closed escrow in November sold for more than list price compared to 46.5% last year and 77.9% in November 2017. For San Mateo County, the ratio was 103.1% versus 103.2% last year and 56% of the closings sold for more than list price versus 55% last year.

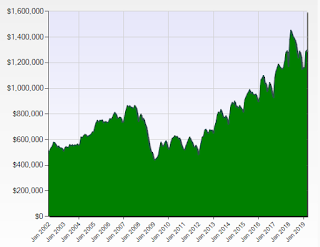

The following graphs of Months of Inventory of single-family residences for Santa Clara County and San Mateo County, respectively. Data are from MLSListings.com transactional information and covers the date range from January 2002 through November 2019. Please notice that for the past 6 years or so the trend has been generally lower.

The following graphs of Months of Inventory of single-family residences for Santa Clara County and San Mateo County, respectively. Data are from MLSListings.com transactional information and covers the date range from January 2002 through November 2019. Please notice that for the past 6 years or so the trend has been generally lower.

The hottest market in Santa Clara County again was the Cupertino/Sunnyvale market area with a median price of about $1.852 million) at 103.0% which means that the average closed sale has a sale price 3.0% higher than the list price! It also registered median days on market of 9 which means half the inventory sold in 9 days! The coolest is the South County market area (Morgan Hill, San Martin, and Gilroy) with a median price of about $0.915 million) with 98.3% and median days on the market of 33.

Days of unsold inventory is another key indicator which is the intersection of supply of available homes compared to demand that is flat or slightly up and stands at 32 for Santa Clara County and 37 for San Mateo County. The current levels place both counties back into a seller's market condition since their levels are below 40. I've seen some so-called experts or recent news articles state that we are in a "buyer's" market, this is clearly NOT the case. Again, sellers need to be careful about their list price and should err more on a lower level lest they get stuck on the market.

The hottest market in San Mateo County last month remains the North Cities (Brisbane, Colma, Daly City, Pacifica, San Bruno, South San Francisco) market area (median price of about $1.080 million) at 107.5% with median days on market of 22. The coolest is the Coast (Half Moon Bay, El Granada, Moss Beach, Montara) market area (median price of about $1.150 million) at 96.7% with median days on the market of 33.

As always, markets are dynamic and the supply and demand in a particular area or even neighborhood can vary and it does so sometimes quickly. If you would like specific market condition information for your area or neighborhood or a current home valuation, please feel free to call me, your RE/MAX Gold Agent! You are welcome to leave your comments or questions or contact me directly at my website. Check out and “like” my Facebook Business Page (over 770 have done so) or follow me on my Twitter Page. Thank you for your i